Best Crypto Exchanges for Latin America in 2025

🌎 Latin America has become a global hotspot for crypto innovation, where economic instability and limited access to banking have pushed millions toward digital currencies. This rapid adoption has created a growing demand for trustworthy and accessible crypto exchanges for latin america that meet the region’s unique needs.

🌎 Latin America has become a global hotspot for crypto innovation, where economic instability and limited access to banking have pushed millions toward digital currencies. This rapid adoption has created a growing demand for trustworthy and accessible crypto exchanges for latin america that meet the region’s unique needs.

💱 As more users across the region dive into Bitcoin, Ethereum, and stablecoins, choosing the right platform is crucial. People want low fees, reliable access to local currencies, and user-friendly apps—factors that separate average platforms from the best crypto exchanges for latin america.

🔐 Security is another key factor, especially in countries where regulation is evolving and scams are on the rise. Users need to know which crypto exchanges for latin america offer strong compliance, transparent policies, and responsive support in Spanish or Portuguese.

🚀 In this article, we’ll explore the most reliable and beginner-friendly crypto exchanges for latin america, helping you find the best platform to buy, sell, and trade with confidence in 2025.

Top Platforms for Crypto Exchange

🔍 What Makes a Good Exchange for LATAM Users?

🧩 Choosing the right crypto platform in Latin America is about more than just low fees—it’s about compatibility with your local reality. Users across the region need crypto exchanges for latin america that offer deposits and withdrawals in local currencies, support local payment methods like Pix or MercadoPago, and allow easy fiat conversion.

🗣️ Language accessibility is another key factor. The best crypto exchanges for latin america provide interfaces, help centers, and customer support in Spanish or Portuguese. This not only improves usability but also builds trust among users who may be new to crypto.

📱 Mobile optimization is vital too. In many Latin American countries, smartphones are the primary way people access the internet. That’s why most of the top crypto exchanges for latin america prioritize app performance, mobile trading features, and smooth onboarding via smartphone.

🔐 Finally, security and regional compliance can’t be ignored. The most trusted crypto exchanges for latin america follow international KYC/AML rules, provide proof of reserves or insurance coverage, and clearly communicate their regulatory standing in each country they serve.

🏅 Top Crypto Exchanges for Latin America

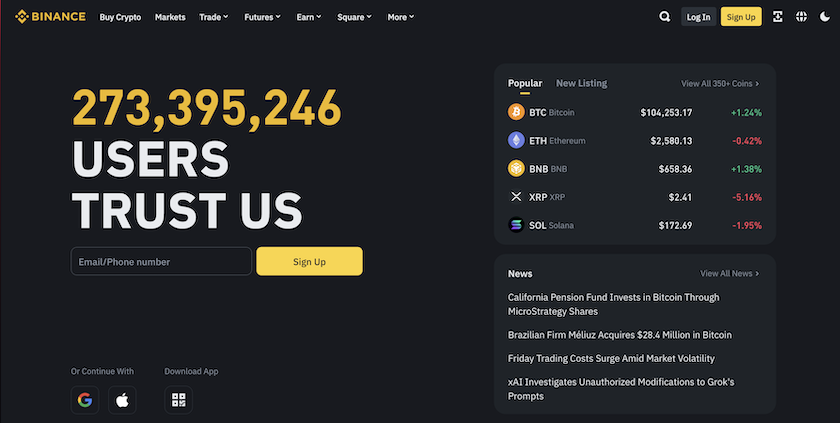

🌐 Binance

🔐 Binance remains one of the most popular crypto exchanges for latin america, offering a seamless experience for both trading and wallet usage. Its built-in custodial hot wallet ensures convenience, while layers of protection like two-factor authentication, encryption, and even multi-party computation (MPC) safeguard user funds.

🔐 Binance remains one of the most popular crypto exchanges for latin america, offering a seamless experience for both trading and wallet usage. Its built-in custodial hot wallet ensures convenience, while layers of protection like two-factor authentication, encryption, and even multi-party computation (MPC) safeguard user funds.

📲 The Binance wallet is available across all major platforms—including iOS, Android, and desktop browsers—and adapts to user experience levels with Lite and Pro interfaces. This versatility is especially valuable in Latin America, where mobile-first access dominates. The app’s Spanish and Portuguese interfaces further boost accessibility across the region.

💸 When it comes to fees, Binance continues to lead the pack. Standard maker/taker trading fees are just 0.1%, and users can enjoy discounts by paying with BNB or leveling up via trading volume. While storing crypto on Binance is free, transferring funds out incurs standard blockchain network fees. Credit card purchases may carry extra charges, but the transparency in their pricing is a big plus.

🌍 With support for over 350 digital assets—including BTC, ETH, SOL, and regionally favored tokens like USDT, BNB, and SHIB—Binance stands out as a versatile solution. Its cross-chain compatibility and P2P trading options are especially beneficial for LATAM users navigating multiple networks and fiat conversion needs.

🧾 Completing KYC unlocks the full suite of Binance features, such as staking, fiat withdrawals, and enhanced security. Altogether, Binance is a powerful and secure option for those seeking top-tier crypto exchanges for latin america.

Binance

Binance Review🛡️ Kraken

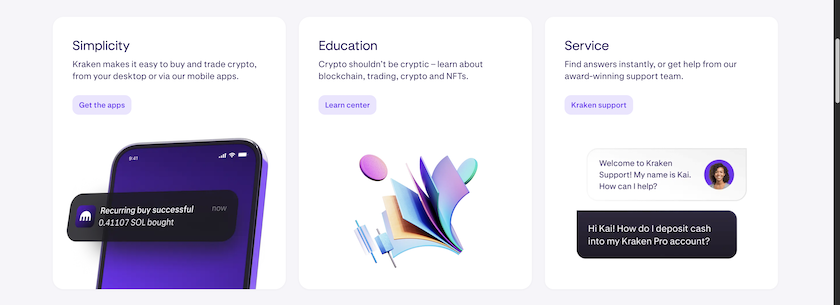

🔒 If you’re looking for unmatched security and professional-grade tools, Kraken stands out among crypto exchanges for latin america. This U.S.-based platform is built around custodial wallet infrastructure, allowing users to access hot wallet functionality while Kraken manages private keys and locks down user funds with industry-best practices like 2FA, cold storage, and advanced features like Global Settings Lock and Master Key.

🔒 If you’re looking for unmatched security and professional-grade tools, Kraken stands out among crypto exchanges for latin america. This U.S.-based platform is built around custodial wallet infrastructure, allowing users to access hot wallet functionality while Kraken manages private keys and locks down user funds with industry-best practices like 2FA, cold storage, and advanced features like Global Settings Lock and Master Key.

📱 Kraken’s mobile and desktop platforms deliver a clean, intuitive experience across Android, iOS, and web browsers. Users can chart market trends, execute complex orders, or manage staking rewards with a few taps. While it doesn’t offer browser extensions like MetaMask, this design choice limits exposure to security threats and ensures interactions happen only in secure, vetted environments.

🪙 With over 400 supported cryptocurrencies, Kraken is ideal for LATAM users who want access to major tokens like BTC, ETH, and SOL, as well as a diverse mix of DeFi assets and staking options. The platform also offers spot, futures, and margin trading, plus API access for algorithmic strategies—features that make Kraken a powerhouse among crypto exchanges for latin america.

💸 Kraken’s fee model is competitive: maker-taker fees decrease based on your 30-day trading volume. Pro users enjoy significant savings, while beginners can use Instant Buy (though at a slightly higher flat rate). Network fees are transparent and passed through without markups, making it easy to plan withdrawals without surprises.

🧾 KYC is required to unlock fiat functions, but the process is fast and secure. For LATAM traders prioritizing safety, Kraken is a fortress in the crypto jungle.

Kraken

Kraken Review📲 OKX

🧠 If you want versatility, low fees, and a sleek interface, OKX is one of the smartest choices among crypto exchanges for latin america. With support for over 300 cryptocurrencies and more than 700 trading pairs, OKX gives LATAM users access to everything from Bitcoin and Ethereum to trending tokens like PEPE, Dogecoin, and Solana—all from one unified platform.

🧠 If you want versatility, low fees, and a sleek interface, OKX is one of the smartest choices among crypto exchanges for latin america. With support for over 300 cryptocurrencies and more than 700 trading pairs, OKX gives LATAM users access to everything from Bitcoin and Ethereum to trending tokens like PEPE, Dogecoin, and Solana—all from one unified platform.

🔐 The wallet built into OKX is a custodial hot wallet, meaning the platform handles private key management. While users don’t have full autonomy over their keys, they benefit from industry-grade security including 2FA, biometric logins, cold storage reserves, and regular proof-of-reserves audits. This structure makes it ideal for users who prioritize convenience without compromising protection.

🧾 Signing up is simple. You can register with a phone number or email in minutes, and completing KYC unlocks full access to features like withdrawals, staking, and higher trading limits. OKX’s encryption policies and fast identity checks add a level of safety and privacy that’s appreciated by users across Latin America.

🖥️ OKX shines on all devices, with top-rated mobile apps and a responsive web interface. Whether you’re a casual user or an active trader, the platform’s clean layout and customizable tools make crypto management smooth and stress-free.

💸 The wallet itself is free, and trading fees are competitively low—starting at 0.08% for makers. For LATAM traders looking for a mobile-first platform with wide asset coverage, OKX is a modern and reliable choice among crypto exchanges for latin america.

OKX

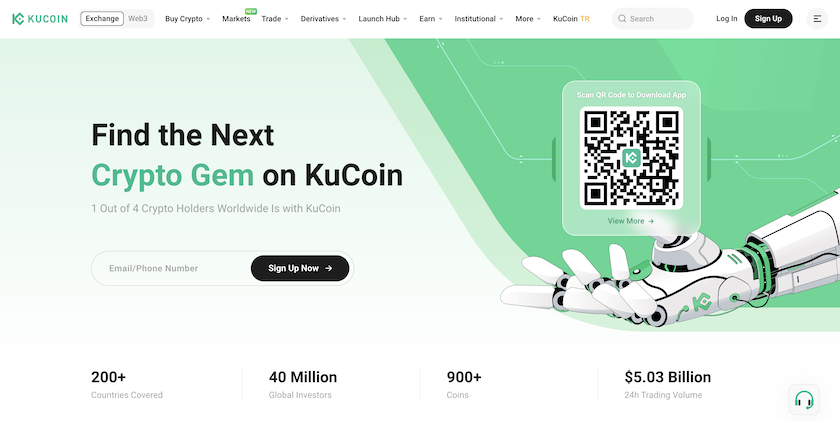

OKX Review💳 KuCoin

🌍 With over 700 cryptocurrencies and support in 200+ countries, KuCoin has established itself as one of the most accessible crypto exchanges for latin america. Known for listing emerging altcoins early and offering low trading fees, it’s a popular choice among LATAM users looking for both diversity and affordability in their crypto journey.

🌍 With over 700 cryptocurrencies and support in 200+ countries, KuCoin has established itself as one of the most accessible crypto exchanges for latin america. Known for listing emerging altcoins early and offering low trading fees, it’s a popular choice among LATAM users looking for both diversity and affordability in their crypto journey.

🔐 The KuCoin wallet is a custodial hot wallet, meaning it’s always online and the platform manages your private keys. While this limits user autonomy, it enhances speed and ease of use—perfect for traders who want instant access to spot, margin, or futures trading features. Security is handled seriously, with tools like 2FA, anti-phishing codes, cold storage, and even biometric login support on mobile.

📱 KuCoin performs well across all major platforms, including Android, iOS, and web browsers. The mobile app in particular is praised for its clean design and intuitive navigation. From Fast Buy to trading bots and staking tools, users can manage everything on the go. Regional support is strong too, with over 20 languages available—including Spanish and Portuguese—making KuCoin a natural fit for the Latin American market.

💸 KuCoin’s trading fees start at just 0.1%, and discounts apply when paying with its native token, KCS. While it doesn’t support native fiat withdrawals, users can rely on P2P features and third-party integrations to convert their crypto. This flexibility—paired with a massive coin list—makes KuCoin a standout among crypto exchanges for latin america for users seeking both options and opportunity.

KuCoin

KuCoin Review💸 Local Currency and Payment Support

💱 One of the most important features users look for in crypto exchanges for latin america is support for local currencies and regional payment methods. Being able to deposit and withdraw funds in Argentine pesos (ARS), Brazilian reais (BRL), Mexican pesos (MXN), and other national currencies reduces friction and makes the crypto experience more accessible to everyday users.

🏦 The top exchanges in this article—Binance, Kraken, OKX, and KuCoin—offer varying degrees of fiat integration. Binance stands out with its peer-to-peer (P2P) marketplace, which supports a wide range of local banks and digital wallets like Pix (Brazil) and MercadoPago (Argentina). Kraken provides fiat support for currencies like USD and EUR, which can be useful for users with access to international banking services. KuCoin and OKX rely on third-party fiat providers like Banxa, Simplex, or Mercuryo, allowing users to buy crypto with BRL, MXN, and more via credit card or local transfer.

📲 Payment convenience is a major factor for LATAM users, many of whom operate in cash-heavy or underbanked economies. That’s why features like P2P trading, instant card purchases, and support for regional payment platforms are becoming essential tools for crypto exchanges for latin america to remain competitive and inclusive.

🔄 While some platforms lack native fiat withdrawals, they often compensate with robust P2P networks and integration with local fintech tools. This ensures users can move between fiat and crypto smoothly, even without traditional banking.

📱 Mobile Experience and Language Options

📲 In Latin America, mobile-first access is the norm. Whether trading from rural regions or bustling cities, users rely heavily on smartphones to manage their crypto. That’s why the mobile experience is a top priority when evaluating crypto exchanges for latin america. A well-designed app can make the difference between smooth trading and frustrating delays.

📱 All four platforms featured—Binance, Kraken, OKX, and KuCoin—offer dedicated apps for Android and iOS, with user-friendly interfaces tailored to both beginners and advanced traders. Binance stands out with its Lite and Pro modes, giving users the freedom to toggle between simple and advanced trading dashboards. OKX and KuCoin are praised for their responsive apps that combine charting, security, and one-tap trading. Kraken’s mobile platform mirrors its desktop features while prioritizing safety with real-time alerts and account controls.

🗣️ Language support is equally crucial. Many users in Latin America are Spanish or Portuguese speakers, and platforms that fail to offer local language options can alienate a large audience. Fortunately, the leading crypto exchanges for latin america all provide full app and web translation in Spanish, and most include Portuguese as well. Some also offer localized educational content and customer support, which builds user trust and confidence.

📞 From real-time push notifications to intuitive navigation and multilingual onboarding, the mobile experience plays a huge role in retaining users—and the best crypto exchanges for latin america know it.

⚖️ Regulation and Safety

🛡️ When dealing with digital assets, safety isn’t optional—it’s everything. For users in emerging markets, where consumer protections are often limited, trusting a platform becomes even more critical. That’s why regulation and strong security practices are essential components when evaluating crypto exchanges for latin america.

🔐 All four platforms featured in this guide implement robust security measures like two-factor authentication (2FA), cold wallet storage for most assets, and encryption of sensitive data. Some go even further: Kraken offers advanced protections like Global Settings Lock and a Master Key, while Binance includes biometric logins and device whitelisting. OKX and KuCoin also perform proof-of-reserves audits to provide transparency about held assets.

🌍 On the regulatory front, things get trickier. Not all crypto exchanges for latin america are locally licensed. Some operate under global or offshore jurisdictions, such as Seychelles or the British Virgin Islands. While this allows them to serve more countries, it also means users must rely on the platform’s internal safeguards rather than national legal systems. That’s why verifying KYC policies and understanding what legal protections are (or aren’t) available in your country is so important.

📑 Fortunately, most major exchanges have taken steps to improve compliance with international AML and data protection standards. They offer detailed KYC processes, transaction monitoring, and responsive fraud teams—essential elements for any platform serving the growing Latin American crypto market.

🎯 Final Thoughts

✅ Latin America is one of the fastest-growing crypto regions in the world, and the platforms serving it must rise to meet user expectations. With growing demand for mobile access, local payment methods, and strong security, users are becoming more selective when choosing among the many crypto exchanges for latin america.

🌐 Binance, Kraken, OKX, and KuCoin each offer a unique balance of features—from beginner-friendly interfaces and mobile apps to advanced tools and deep altcoin markets. While regulatory nuances and fiat support vary by country, these platforms have proven themselves reliable and adaptable for users across the region.

🧠 Ultimately, the best exchange is the one that fits your personal needs. Whether you want to trade Bitcoin daily, stake Solana, or explore newly launched tokens, the right platform is out there. Just remember to prioritize security, complete your KYC, and always be mindful of fees and withdrawal options.

🚀 With the right tools in hand, navigating the world of crypto becomes easier—and thanks to the leading crypto exchanges for latin america, LATAM users have more choices than ever before to take control of their financial future.