Coinbase Expansion Embraces Onchain Finance

Coinbase is doubling down on its blockchain-first future with an ambitious move to become a one-stop-shop for all things finance.

📈 Coinbase Expansion Goes Beyond Crypto

📈 Coinbase Expansion Goes Beyond Crypto

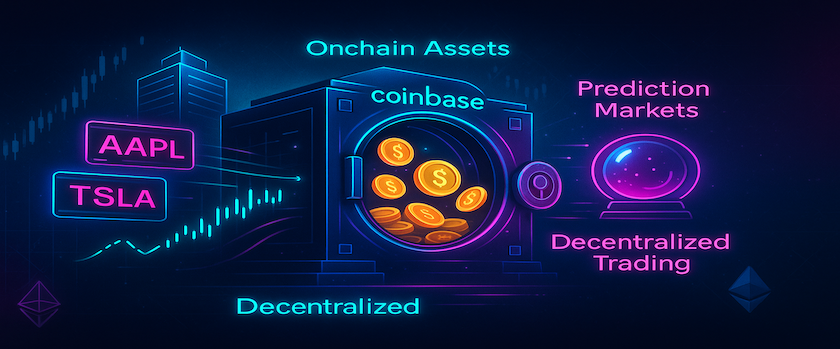

Coinbase expansion plans are now crystal clear—the company wants to be more than a crypto exchange. Its vision includes trading tokenized stocks, prediction markets, and other onchain financial assets. Despite a dip in trading volumes during Q2 2025, the company is not retreating but rather racing forward, betting on a decentralized future that blends traditional finance with the transparency and efficiency of blockchain.

🔗 All Roads Lead Onchain

Max Branzburg, Coinbase’s Vice President of Product, detailed how the Coinbase expansion involves developing a unified platform for trading all types of assets securely onchain. The platform will feature tokenized equities, early-stage token launches, and even prediction contracts. With blockchain at its core, Coinbase aims to eliminate the borders and delays of conventional markets, appealing to both institutional giants and curious retail traders seeking smarter, faster trading solutions.

⚖️ Policy Winds Favor Coinbase Expansion

The Coinbase expansion is also fueled by significant regulatory shifts in the U.S. The introduction of the GENUIS Act and CLARITY Act has brought much-needed legal structure to stablecoins and digital assets. These changes have emboldened Coinbase’s leadership, providing the clarity needed to build and scale innovative products. Even as overall revenue dipped by 26% in Q2, Coinbase cited these laws in its shareholder letter as green lights for moving full speed ahead.

📊 A Bridge Between Finance and Crypto

At the heart of the Coinbase expansion is the belief that financial markets are going onchain—whether it’s stock trading, speculative contracts, or new asset classes altogether. Coinbase wants to be the gateway for this transition. While U.S. laws still restrict many event-based prediction markets, the company is betting that the tide will turn. Platforms like Kalshi and Polymarket are already testing those waters, but Coinbase’s infrastructure and reach could turn niche use cases into mainstream offerings.

💸 Stablecoins Show Promise Amid Trading Slump

Despite a weaker quarter for traditional trading revenue, the Coinbase expansion is supported by growth in stablecoin-related activity, which rose by 12%. This partly cushioned the downturn and showed that services beyond crypto trading are gaining traction. The exchange believes subscription and service-based revenue will continue growing, indicating a long-term shift toward diversified income streams. Coinbase is clearly positioning itself to lead in more than just Bitcoin and Ethereum.

🌍 Mainstreaming Tokenized Markets

Coinbase expansion isn’t just about business—it’s about reshaping how people interact with markets. If successful, this initiative will make it easier for millions to access tokenized stocks and blockchain-based financial tools. This could lead to faster settlements, lower fees, and more financial inclusion worldwide. It’s a bold step toward a future where markets never close and access isn’t tied to location or banking infrastructure.

📣 The Prediction Market Push

One of the boldest elements of the Coinbase expansion is its plan to enter prediction markets, a segment that has historically faced tough regulatory hurdles. Kalshi remains the only licensed U.S. player, while Polymarket is preparing for a relaunch. If Coinbase enters the space with proper licensing, it could bring credibility and volume to a market currently seen as a crypto niche. With its vast user base, Coinbase could become the go-to platform for everything from sports odds to political outcomes—all powered by smart contracts.

💼 Redefining the Financial Superapp

The Coinbase expansion draws inspiration from the “superapp” model seen in Asia, where platforms bundle payments, trading, social features, and more. By offering tokenized financial products under one roof, Coinbase could compete not just with crypto exchanges but also with brokers like Robinhood, eToro, or even centralized betting sites. This cross-industry ambition reflects a growing belief: the future of finance is not fragmented—it’s consolidated and onchain.

🧱 Infrastructure is the Key to Scale

Behind the scenes, the Coinbase expansion relies on its robust blockchain infrastructure. With a proven track record in scaling retail and institutional tools, the company is well-placed to roll out complex new products like tokenized assets. The secure custody systems and regulatory engagement give Coinbase an edge in pushing boundaries while remaining compliant. For users, this means access to new financial tools without compromising security or trust.

🚀 A Call to Action for the Industry

The Coinbase expansion could inspire other exchanges and fintech platforms to diversify their offerings. As competition heats up, users can expect a richer ecosystem of blockchain-native financial tools. Coinbase may be the first major exchange to embrace this all-in-one approach, but it likely won’t be the last. The age of siloed platforms is fading, replaced by a vision of finance that is fast, flexible, and fundamentally decentralized.